How Soon Can You Refinance A Boat Loan

Ronan Farrow

Mar 23, 2025 · 3 min read

Table of Contents

How Soon Can You Refinance a Boat Loan?

Thinking about refinancing your boat loan? It's a smart move that could save you money on interest payments and potentially lower your monthly payments. But how soon can you actually do it? The answer isn't as straightforward as you might think, and depends on several factors.

Understanding Boat Loan Refinancing

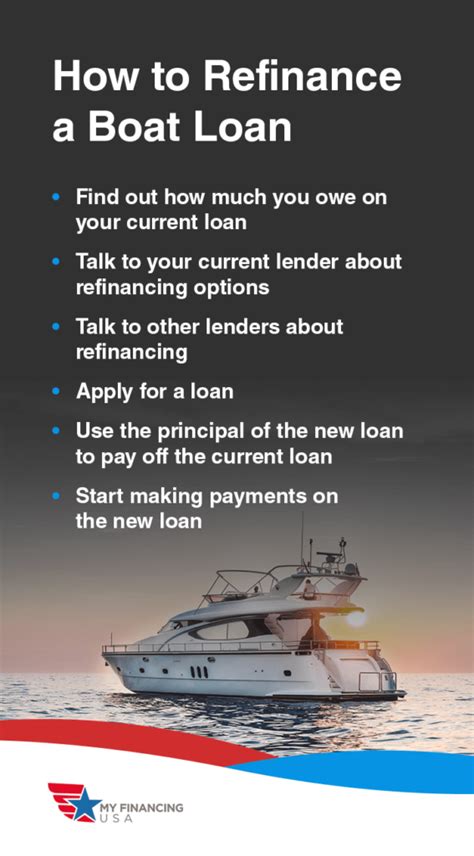

Before diving into the timeframe, let's quickly cover what boat loan refinancing entails. It's essentially the process of replacing your current boat loan with a new one, often from a different lender. This could be beneficial if you've improved your credit score, interest rates have dropped, or you want a more favorable loan term.

How Long Should You Wait?

There's no magic number of months you must wait before refinancing your boat loan. However, most lenders prefer to see some history with your current loan. A general guideline is to wait at least six months, sometimes even a year, before applying for refinancing.

Why the Waiting Period?

Lenders want to assess your responsible repayment behavior. Showing a consistent track record of on-time payments for six months to a year demonstrates your financial responsibility and increases your chances of approval for a refinance.

Factors Affecting Refinancing Eligibility

Several factors influence your eligibility for refinancing a boat loan, impacting how soon you can realistically apply:

1. Your Credit Score

A strong credit score significantly improves your chances of getting approved for refinancing with a lower interest rate. If your credit is currently poor, working to improve it before applying is crucial.

2. Loan-to-Value Ratio (LTV)

Your LTV is the ratio of your loan amount to the current value of your boat. A lower LTV generally makes refinancing easier, as it reduces the lender's risk. Regular maintenance and upkeep are essential in maintaining the value of your boat.

3. Outstanding Loan Balance

A smaller outstanding loan balance compared to the boat's value also contributes to a lower LTV and improves your chances.

4. Lender Requirements

Each lender has its own specific requirements and criteria. Some might be more flexible than others regarding the minimum time you need to have held your current loan.

When is Refinancing Most Beneficial?

Refinancing might be most advantageous when:

- Interest rates have fallen: A significant drop in interest rates allows you to secure a lower rate, potentially saving you thousands of dollars over the life of the loan.

- Your credit score has improved: A better credit score will qualify you for more favorable loan terms.

- You want a shorter loan term: While this means higher monthly payments, you will pay less interest in the long run.

Steps to Prepare for Refinancing

Before you apply for refinancing, take these steps:

- Check your credit report: Identify and address any errors that might be affecting your score.

- Shop around for lenders: Compare interest rates and loan terms from several lenders.

- Gather necessary documents: Be ready to provide proof of income, employment history, and your boat's value.

Refinancing your boat loan can be a smart financial strategy. By understanding the factors involved and taking the necessary steps, you can position yourself for a successful application and potentially save money in the long run. Remember that patience and responsible financial management are key.

Featured Posts

Also read the following articles

| Article Title | Date |

|---|---|

| How To Become A Professional Dungeon Master | Mar 23, 2025 |

| How Much Tune Up Motorcycle | Mar 23, 2025 |

| How To Become Justice Of The Peace Ct | Mar 23, 2025 |

| How Much Meat On A Cow Elk | Mar 23, 2025 |

| How Much Wheel Hp Does A Hellcat Have | Mar 23, 2025 |

Latest Posts

-

How Many Miles To A Tank Of Gas

Apr 07, 2025

-

How Many Miles Should A 2015 Car Have In 2023

Apr 07, 2025

-

How Many Miles Per Gallon Does A Volkswagen Atlas Get

Apr 07, 2025

-

How Many Miles Per Gallon Does A Mitsubishi Mirage Get

Apr 07, 2025

-

How Many Miles On Bike To Lose Weight

Apr 07, 2025

Thank you for visiting our website which covers about How Soon Can You Refinance A Boat Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.